40% more already from January: which Ukrainians will have to pay huge taxes.

From January, Ukrainians will have to pay 40% more in taxes if they vote for bill No.11416-d. This follows from the analysis of the state budget project. The law envisages the imposition of a military levy on individual entrepreneurs (IE) ranging from 1% to 10% of their income or the minimum wage. But the exact amount of tax increase will be different for different groups of entrepreneurs.

The most affected will be IEs of the first group of the single tax, for whom the total payment will be 2862 UAH 80 kopecks compared to the previous 2062 UAH 80 kopecks. This is almost 40% more. For IEs of the second and fourth groups of the single tax, tax payments will increase by 800 UAH, and for IEs of the third group - by approximately 20%.

However, the actual increase in payments is likely to occur only in 2025 due to the specifics of tax reporting. The NBU also emphasizes the risk of increasing the profit tax on banks to 50%.

Read also

- Gas stations have halted the rise in fuel prices: what is happening with gasoline, diesel, and autogas

- Drivers were shown how much they paid for pedestrian accidents

- Ukrainian Metallurgy Against Global Giants: New Rankings

- Business received state support of 3.6 billion UAH: leading regions and industries

- Macron calls for the rearmament of Europe due to Russian aggression: how France's military budget will increase

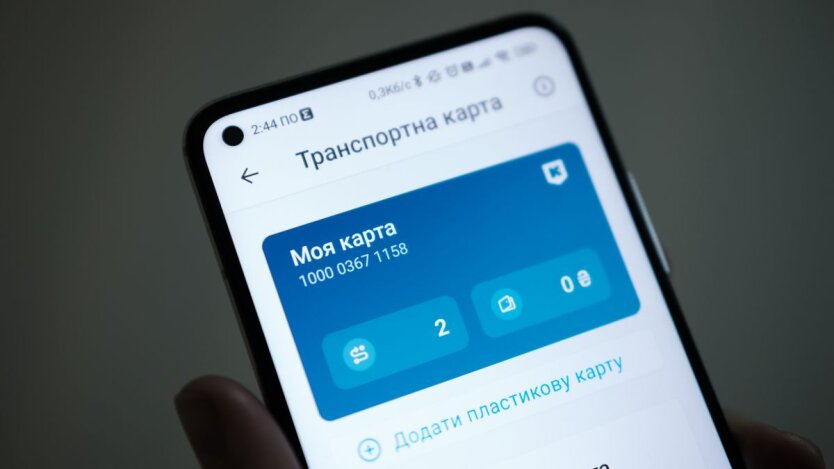

- In Ukraine, prices for transport cards will increase: how much will it cost